There are many reasons buyers wish to find a property that is undervalued. It is rare to find a perfectly remodeled home with no defects priced low. REALTORS® representing sellers are savvy and know that a sale ready home will command a top dollar. So, those willing to get a good deal on a property should assume there will be some upgrades necessary to be done on the place to bring it to a sale ready state.

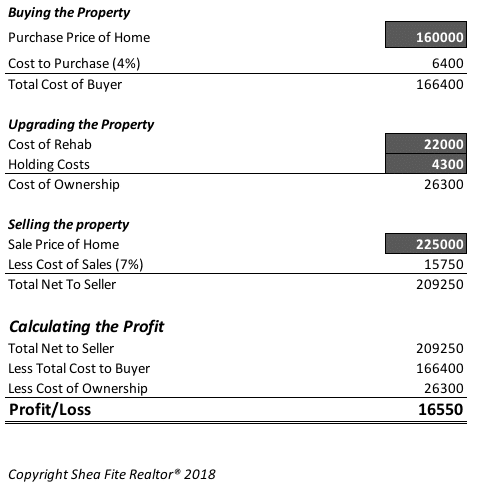

The formula for understanding if a property is a good deal to flip is not as simple as many assume. It goes in three phases. Buying the property. Upgrading the property. Then selling the property for top dollar.

When Buying the Property

Purchase Price of Home + Cost to Purchase = Total Cost of Buyer

There is only one real way to win in real estate investing. It is when you buy. This is because if an investor pays to much, he will be overcoming this throughout the entire project. Here are a few definitions to understanding all the costs one will incur purchasing a property.

Purchase Price of Home: This is the most obvious line item. The sale price of the home when the buyer purchases the property.

Cost to Purchase: Generally, this includes the fees bankers charge to obtain a loan, inspections, prepaid expenses for insurance, property taxes, title work, etc. A good estimate is 3.5 to 4.5% of sale price. However, a better estimate is provided by your trusted REALTOR® on the Estimated Cost to Buyer worksheet. It will be included in the paperwork one signs before delivering an offer.

The purchase price of the home plus the costs associated with buying it gets you an excellent view of what the total cost of aquiring the property is.

When Upgrading the Property

Cost of Rehab + Holding Costs = Cost of Ownership

There is a well known rule of thumb when predicting any renovation costs. Add 20% to your final estimates. This is because there is almost always unknown cost revealed during the demolition phase of construction. Hidden items under subfloors, behind tile, above the ceiling. The possibilities are near infinite.

Cost of Rehab: This is the cost the buyer incurs from upgrading the property and repairing items that impede the value of the property. Carpet, tile, paint, opening up kitchens, and fundamental repairs.

Holding Costs: It is most accurate to include the cost of utilities, interest and mortgage payments, property taxes incurred to maintain the investment property while it is being upgraded then marketed. This is the often overlooked costs of investing in real estate. Property held shorter than certain IRS timelines may be subject to tax on the profit. This is called Capital Gains. Check with your CPA regarding your specific situation and plans. How long you “hold” the property matters in terms of costs incurred and one needs to have those cost factored in.

Adding all the cost of renovations and your holding costs will get you a clear idea of what specifically it will cost for you to own the property.

When Selling the Property

Sale Price of Home – Cost of Sales = Total Net to Seller

Rarely does the sale price of a property tell the whole story. There is transaction costs.

Sale Price of Home: This is the sale price of the home agreed upon by the next buyer.

Cost of Sales: This includes the commissions paid to both the selling agent and the listing agent. It is rare that your listing agent will make all of the commission paid in the transaction. Most usually that amount is split between the listing agent and the agent representing the buyer. Cost of sales also includes any title work and repairs that the buyer and seller negotiate prior to closing on the property. A good estimate of your Cost of Sales is presented by your REALTOR® on the form “Estimated Net to Seller”.

Calculating the Profit

Total Net to Seller – Total Cost of Buyer – Cost of Ownership = PROFIT/LOSS

Predicting profit or loss is most important when considering the purchase of a property. We want to help and have included a link to a simple spreadsheet you can modify to help understand any property.

Recent Comments